Saturday, 11 April 2020

- Small business owners face the challenge of adapting their businesses to ‘a new normal’

- Many of Malaysia’s small businesses entered pandemic crisis in good financial heal

While the national Small and Medium Enterprise (SME) Association of Malaysia and its members are screaming out for government help to ease their way through the turbulent waters of the coronavirus, along comes a survey by a global accounting body that says Malaysian SMEs are actually in good shape to face the market disruptions of today. 300 Malaysian-based SMEs participated in the survey.

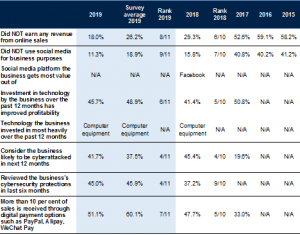

According to a survey of small businesses across the Asia Pacific by CPA Australia, one of the world’s largest accounting bodies, many of Malaysia’s small businesses reported both reasonably strong finances and usage of digital technology in 2019, making them well-placed to manage through the COVID-19 crisis and to recover fairly quickly.

CPA Australia’s Asia-Pacific Small Business Survey 2019-20 found that many of Malaysia’s small businesses entered the pandemic crisis in good financial health with over two-thirds (67.7 per cent) reporting that they grew in 2019, and only 16.3 per cent of businesses finding it difficult to pay business debts in 2019.

In addition, with over half (51.7 per cent) of Malaysia’s small businesses in 2019 generating greater than 10 per cent of their sales online, they are well placed to offset at least some of their lost sales from traditional means, and to respond to significant shifts in consumer behaviour to online sales that the Movement Control Order (MCO) is driving, which is likely to continue well after the MCO is lifted.

CPA Australia’s General Manager of External Affairs, Paul Drum (pic) warned that while the results were on balance positive for Malaysia, past performance is no guarantee of future success.

“With this crisis, small businesses have little margin for error. Prudent management, focusing on the changing needs of customers and even greater adoption of technology, rather than good fortune, will be essential to business recovery and ongoing future success.

“The business you had before this pandemic hit will not be the same as the business you have after the pandemic abates and economic activity recovers. Small business owners face the challenge of adapting their businesses to ‘a new normal’ at a time when finances are tight, although stimulus measures by the government are easing that particular challenge,” says Drum.

The survey results show that many of Malaysia’s small businesses are well-managed and focused on their customers.

The top four factors that had a positive influence on Malaysia’s small businesses in 2019 were:

- Customer loyalty

- Improved customer satisfaction

- Good staff

- Improved business strategy

CPA Australia – Malaysia Country Head Priya Terumalay pointed out that the survey results continue to show year after year, through both good times and bad, businesses with a focus on their customer, technology and strategy are much more likely to be growing strongly than other businesses.

“While it is wise to focus on cash flow and financial health at this time, businesses should also be looking to how they can meet the fast-changing needs of customers, especially through increasing online sales.

“While over half of Malaysia’s small businesses generate more than 10 per cent of their sales online, if a large proportion of Malaysia’s small businesses are to recover, that result will need to be far higher by the time we run this survey again at the end of this year.

“Given that nearly all Malaysian businesses invested in technology in 2019 and that 45.7 per cent stated that such investment was already profitable, it looks as if many of Malaysia’s small businesses have the digital capability to expand their online sales in 2020,” says Priya.

CPA Australia has the following suggestions for Malaysia’s small business in this difficult period:

- Focus on improving cash flow and your financial health

- Utilise technology and online sales to meet changing consumer behavior

- Capitalise on your existing pool of loyal customers

- Investigate the SME relief measures announced by the government, especially as Malaysia’s small business were the least likely to report easy access to finance in 2019

- Dedicate any spare time you may have to developing and implementing a recovery plan, and learning about industry trends and emerging technologies and how they can be applied to your business

- Ask staff with any downtime to undertake training so they are better skilled to meet the recovery needs of your business

- If you are in a relatively strong financial position, keep an open eye to any opportunities that may emerge in the recovery

- Seek professional advice.

The 11th CPA Australia annual survey comprised extensive surveying of 4,193 small business operators in eleven markets, including Malaysia, Australia, Hong Kong, India, Indonesia, Mainland China, New Zealand, Philippines, Singapore, Taiwan and Vietnam. The survey was conducted between 18 November and 12 December 2019 before Covid-19 pandemic.

Find the right insurance for your business

Already know what you need?

Stay Updated!

Get instant access to the latest news, updates and more.

ADVERTISEMENT